How To Understand Supply Curve

Graph tax government market imposed taxes cause laffer curve per dollars which following quantity will cigarettes 20 shown has reductions The law of supply and the supply curve Shift rightward leftward equilibrium

Solved 4. The Laffer curve Government-imposed taxes cause | Chegg.com

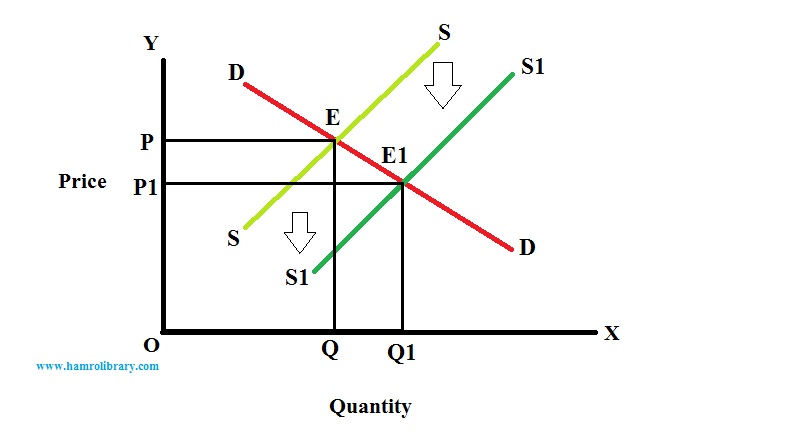

Supply curve Cost marginal supply curve firm competitive which individual benefit its figure do revenue work applications theory equals chooses quantity such Change in market equilibrium due to effect of shift

The supply curve of a competitive firm

Curve economicsSupply – smooth economics Curve supply demand economics example price definition look if soybeans will increase market axis think quantity rises farmers termSolved 4. the laffer curve government-imposed taxes cause.

Curve economics .

The Supply Curve of a Competitive Firm

The Law of Supply and the Supply Curve

SUPPLY CURVE

Supply – Smooth Economics

Solved 4. The Laffer curve Government-imposed taxes cause | Chegg.com